Pricing Your Product Effectively With These 3 Tips

The little things matter. You may have heard that before but it definitely holds true when it comes to pricing your product. Utilizing the right pricing technique could be the difference between a positive and negative 200% change in revenue. How can you choose the right technique? Here’s 3 time tested and proven strategies to get you started.

Pricing Your Product Strategy #1: Charm Pricing

We’ve all seen it at some point, the classic ninety-nine cent gimmick add on. But here’s a few things you may not have known about “Charm Pricing”.

While it may have begun as the psychology of $10 vs. $9.99, humans are now conditioned to simply associate the number 9 with good deals. In one study by MIT women’s clothing was tested at 3 different prices: $34, $39, and $44. You might expect that the lowest price had the most sales, but in fact, the $39 price tag had more sales than either of the other options.

Some say charm pricing is most effective when the left digit is reduced by 1. For example, $10 would become $9.99 and $20 would become $19.99

Despite the rounding down benefit using the .99 charm is also found more effective when comparing to competitors. Therefore if your product is in competition with another and consumers compare pricing consider rounding down. For example, if your competitor is priced at $8 your optimum pricing may be $7.99.

99 cents vs 95 cents

Another controversy lies in the cents. Some argue .99 is more effective than .95. While some companies may use either option interchangeably, one study found online showed that a bike shop price adjustment from $2.99 to $2.95 resulted in nearly $100 more profit.

Pricing Your Product Strategy #2: Decoy Pricing

Decoy pricing is by far my favorite and personally the most effective for me when it comes to pricing your product. Decoy pricing, also known as “useless pricing,” relies on a third unappealing price point for your product to drive up the value on your preferred and probably most expensive option.

One popular case study on this covers Economist Magazine subscriptions.

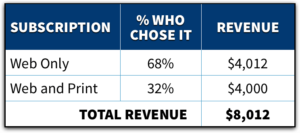

The first image shows the purchase preference of students for the Economist Magazine. The two options include: Web Edition & Web + Print Editions. For “Web Only” they charged $59, but for “Web and Print,” they charged $125.

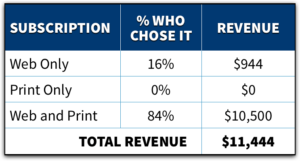

Now, using the same prices a third and less attractive option (the decoy) was introduced: they added a “Print Only” option for the same price as “Web and Print.” Adding the decoy led to a 52% increase in sales for the magazine’s most expensive option. This translated to an additional $3,432 of revenue in a study of only 100 students!

You can find this pricing strategy used by companies on popular products such as: The iPod, The New York Post, and popcorn at movie theaters!

Click here to read more about decoy pricing or here to watch an informative video on decoy pricing using the above examples.

Pricing Your Product Strategy #3: Emotional vs. Rational Pricing

This strategy has contradicting case studies on pricing your product so I’ll cover both.

The first case study reports that emotional purchases should be round numbers, meaning no cents. This is because round values ($50) encourage a reliance on feelings when purchasing.

Rational purchases, on the other hand, should have cents ($48.73) included because they rely on cognition (brain power).

The second case study essentially contradicts the direct evidence provided by Wadhwa & Zhang. This study states that, even in emotional purchases, a buyer will assume pricing to be artificially higher if given as a round number.